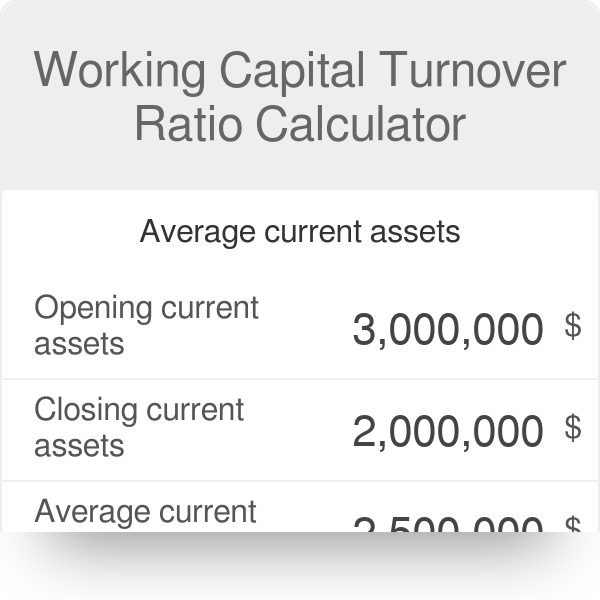

working capital turnover ratio calculator

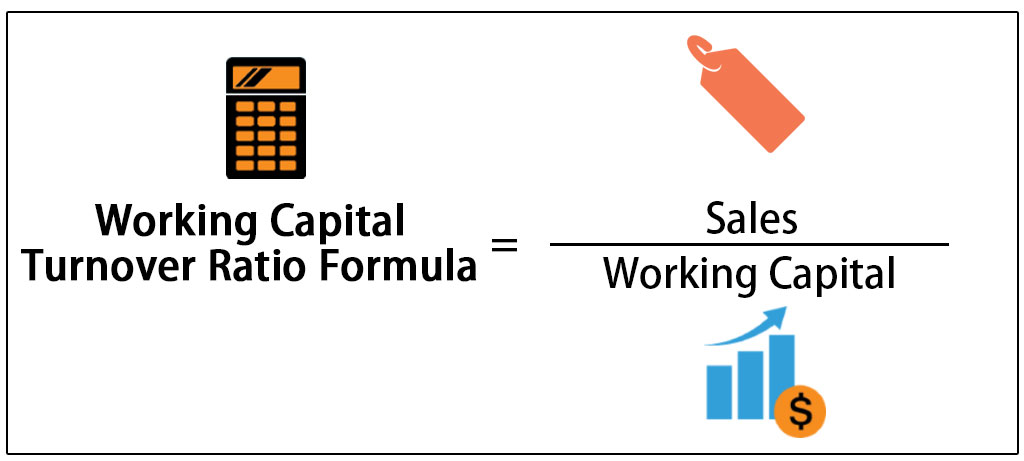

The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. As a reminder.

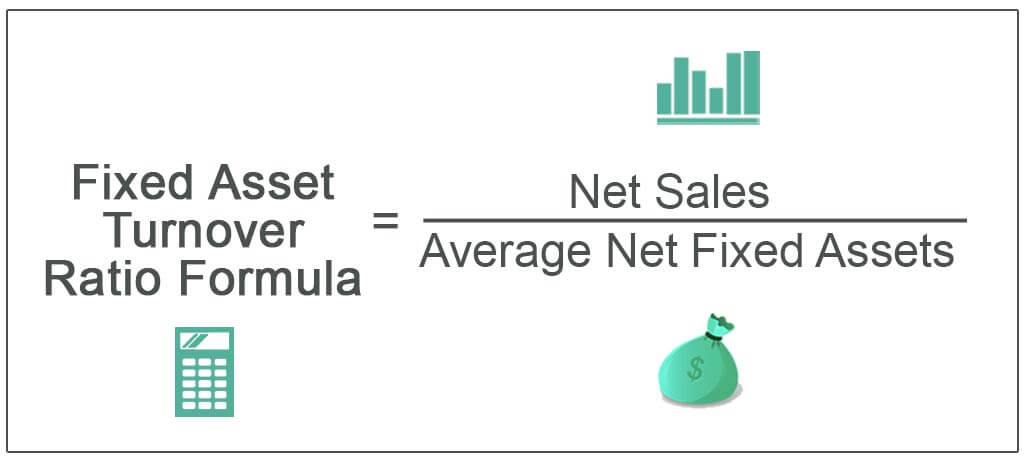

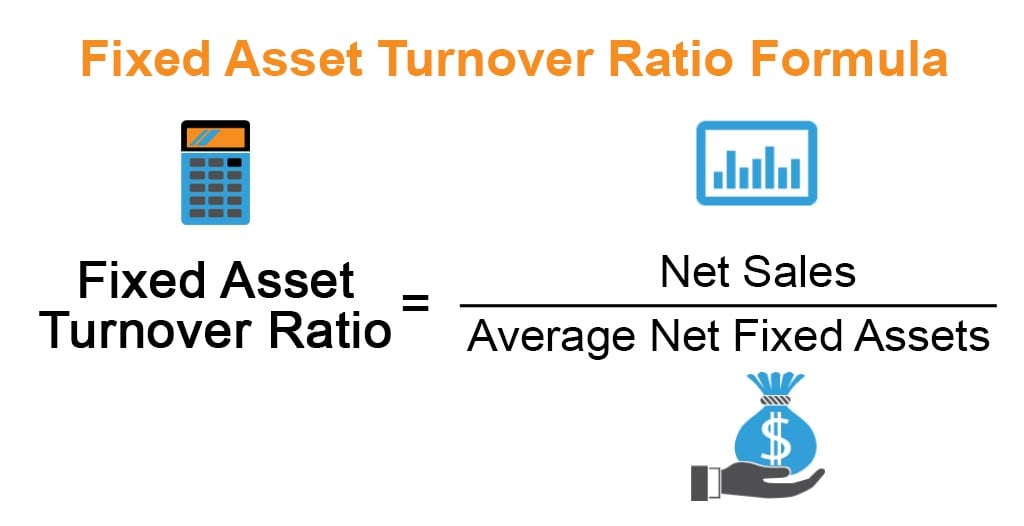

Fixed Asset Turnover Ratio Formula Calculation Examples

This ratio would be indicating that the company is struggling to.

. From the 20x working capital turnover ratio we can conclude that the business generates 2 in net sales for each dollar of net working. It doesnt necessarily have any impact on the companys working capital. Information about your total liabilities and your total assets can typically be found on your balance sheet.

How to calculate a working capital turnover ratio. Working capital can be calculated by subtracting the current assets from the current liabilities like so. To arrive at the average working capital you can sum.

This ratio indicates the number of times the working capital is turned over in the course of a year. If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. The formula to determine the companys working capital turnover ratio is as follows.

You can easily calculate the Working Capital using the Formula in the template provided. In general the more working capital the less financial difficulties a company has. Once you know your working capital amount divide your net sales for the year by your working capital amount for that same year.

Average working capital would be the average of 20000 and 24000. It doesnt necessarily have any impact on the companys working capital. Working capital turnover ratio formula.

Working Capital Current Assets - Current Liabilities. Now working capital Current assets Current liabilities. When a companys accounts payable are extremely high the working capital turnover indicator may be deceiving.

Interpreting the Calculator Results If Working Capital Turnover increases over time. It is very easy and simple. Before you can calculate your working capital turnover ratio you need to figure out your working capital if you dont know it already.

Use the following formula to calculate the net working capital ratio. Together with ratios such as inventory. Working capital turnover ratio is an analytical tool used to calculate the number of net sales generated from investing one dollar of working capital.

This ratio needs to be used in conjunction with other ratios especially inventory turnover to make an informed decision. Working Capital Current Assets Current Liabilities. Since we now have the two necessary inputs to calculate the working capital turnover the remaining step is to divide net sales by NWC.

The calculation would be sales of 320000 divided by average working capital of 22000 which equals a working capital turnover ratio of 145 times. The Cash Conversion Cycle will be a better measure to determine the companys liquidity rather than its working capital ratio. Working Capital Current Assets Current Liabilities.

The formula to measure the working capital turnover ratio is as follows. The working capital turnover ratio calculation ignores disgruntled employees or economic downturns both of which can have an impact on a companys financial health. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company.

A WCR of 1 indicates the current assets equal current liabilities. An increasing Working Capital Turnover is usually a positive sign showing. A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue.

This means that for every 1 spent on the business it is providing net sales of 7. We calculate it by dividing revenue by the average working capital. Working Capital Turnover 190000 95000 20x.

Example of the Working Capital Turnover Ratio. A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations. For a firm to maintain Working Capital Ratio higher than 1 they need to analyze the current assets and liabilities efficiently.

The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as a result. Generally if the Working Capital Ratio is 1 it entails the company is not at risk and can survive once the liabilities are paid. This ratio measures the efficiency with which the working capital is being used by a firm.

420000 60000. Current Assets and Current Liabilities. 150000 divided by 75000 2.

For example if a company makes 10 million in sales during a calendar. Generally if the Working Capital Ratio is 1 it entails the company is not at risk and can survive once the liabilities are paid. You need to provide the two inputs ie.

About Working Capital Turnover. The calculation of its working capital turnover ratio is. The Working Capital Turnover ratio measures the companys Net Sales from the Working Capital generated.

Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. WC Turnover Ratio Revenue Average Working Capital. 100000 40000.

The Cash Conversion Cycle will be a better measure to determine the companys liquidity rather than its working capital ratio. Working capital Turnover ratio Net Sales Working Capital. This means that XYZ Companys working capital turnover ratio for the calendar year was 2.

Working Capital turnover ratio indicates the velocity of the utilization of net working capital. We need to calculate Working Capital using Formula ie. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000.

What is the working capital turnover ratio for Year 3. Putting the values in the formula of working capital turnover ratio we get. The resulting number is your working capital turnover ratio.

Working capital is calculated by subtracting a companys total liabilities debts from its total assets. Also some companies can have a very high ratio due to financial limitations. High working capital turnover ratio is an indicator of efficient use of the companys short-term.

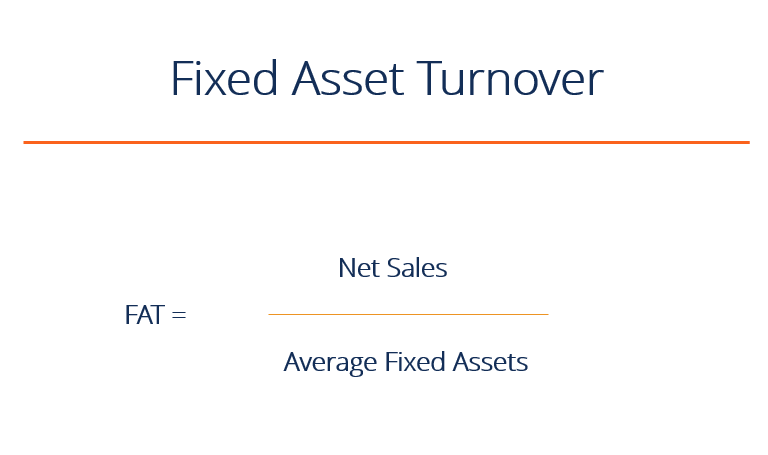

Fixed Asset Turnover Ratio Formula Calculator Example Excel Template

Working Capital Turnover Ratio Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

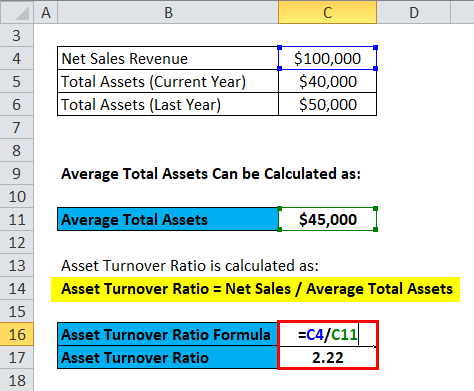

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Fixed Asset Turnover Ratio Double Entry Bookkeeping

Accounts Receivables Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Fixed Asset Turnover Ratio Formula Calculation Examples

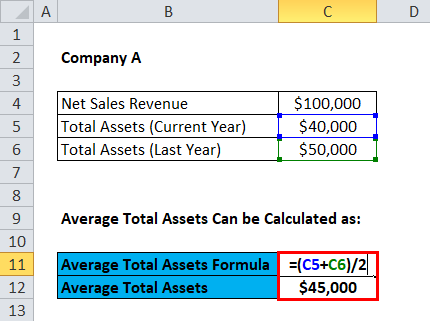

Asset Turnover Ratio Formula Calculator Excel Template

Fixed Asset Turnover Overview Formula Ratio And Examples

Asset Turnover Ratio Formula And Excel Calculator

Efficiency Ratios Archives Double Entry Bookkeeping

Activity Ratio Formula And Turnover Efficiency Metrics

Asset Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template